Find out if you qualify!

Interested in working together? Fill out some info and we will be in touch shortly! We can't wait to hear from you!

Want to know what metrics we use? The USDA has outlined the following :

Step 1

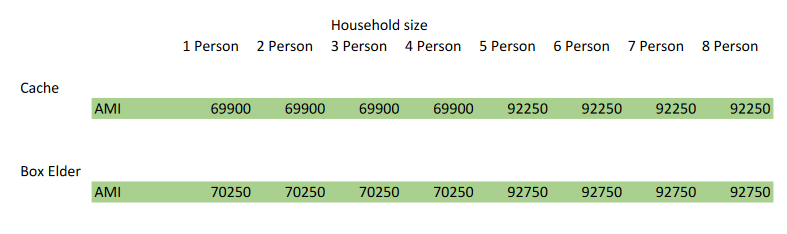

To qualify for the USDA loan for the Owner-Builder Program, you will need to be within the upper and lower income limits determined by the USDA (which are specific to location). We have developed a chart to help you identify the local limits. However, our counselors can help answer questions and fine tune your “allowable income deductions” so if you are close to the upper limit below please reach out to us to see if you may still qualify!

Step 2

You need to have a credit score of 640 or higher. (Don’t be discouraged if your current score is a bit lower, our counselors can help you understand some ways you can personally raise your current score to qualify).

Evaluate your debt to income ratio. Debt payments include: credit cards, student loans (.5% of the balance if they are in deferment/forbearance OR monthly payment amount if they are on an income based repayment plan), car payments, child support, alimony, or any other installment loans. If you are unsure what qualifies as a debt, bring the relevant information and your counselor can help you know what should be included in your debt profile. Don’t be discouraged, your counselor may also be able to help you discover ways to quickly pay off or eliminate debts.

Step 3

You cannot currently have ownership in a house or property when applying for this program. The property in question would need to be sold before a mortgage application can be submitted. If you have had a foreclosure or bankruptcy within the past 3 years you will not qualify. Don’t hesitate to contact us if you have questions about a past foreclosure or bankruptcy.

Step 4

You must be willing to work at least 35 hours per week (you and/or a personal representative) on all of the houses within your group until they are finished (an average of 11-12 months should be expected). Friends or family over the age of 16 may help with the required 35 hours per week. Please note that there are mandatory work hours required from each household. Required participation hours are: Saturdays from 8:00 a.m. to 6:00 p.m and on Tuesday, Wednesday, Thursday from 4:00 - 9:30 pm. Someone from your household must be present for all of these hours. If you have a medical emergency or a planned absence, you must have a volunteer take your place during your absence. Please note: the required hours do not add up to the 35 hours necessary each week, so having additional volunteer hours is imperative.

Step 5

Step 6

Your counselor will help ensure you do not have what the USDA calls “Payment Shock”. This occurs when your future mortgage payment is equal to 100% or more of what you currently pay in rent. For example if you currently pay $600 per month in rent, your future mortgage could not exceed $1199 or you would have “Payment shock”. Not to fear however, we can help you quickly overcome this issue and help you qualify! By working with a financial counselor, you will know what changes you need to personally make and how long it will take you to become ready to build your own house!